Blog tagged as Business Valuation

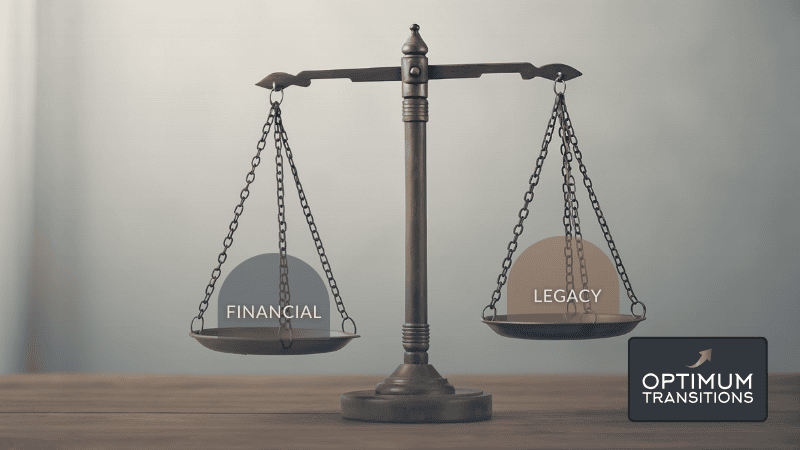

The most satisfied business sellers aren't the ones who got the highest price—they're the ones who negotiated for outcomes that truly matter. Discover the 5 non-financial factors that define a successful exit: legacy preservation, employee welfare, community impact, and personal purpose.

Even elite quarterbacks need coordinators to win. Your business transition deserves the same. M&A advisors provide strategic expertise, pattern recognition, and coordination that maximize value. Your "Chief" responsibility—don't leave your exit to chance.

Think you can sell your business solo? Most DIY sellers leave 15-25% on the table. Discover why broker fees often pay for themselves, when going alone makes sense, and the hidden costs that could tank your deal before you even know what hit you.

Most business owners destroy value by mixing real estate into business valuations. Smart sellers separate them: adjust to market rent, value each independently, then add together. Result? Higher total value since real estate gets proper multiples, not discounted business rates.

Seller financing can boost your sale price, expand your buyer pool, and let you choose the right successor. The typical sweet spot is financing 5-20% with 5-10 year terms. Work with advisors to structure terms that protect your interests.